Cost of running an electric car

Are you ready to go electric?

Want to know if an electric car is the right choice for you?

Join in with our simple online quiz to find out more.

The world is changing and sustainability continues to be more and more of a priority for many people. Electric vehicles (or “EVs”) have become one of the most popular ways for people to reduce their environmental impact, so it’s perhaps unsurprising that there are now more than one million EV drivers in the UK.

But running an electric car still costs money, so understanding all the costs involved is crucial to help you decide if an electric vehicle is right for you.

In this article, we’ll explore all the expenses involved with running an electric car and share some of the benefits and disadvantages of having one – from fuel savings, right down to cost per mile and servicing.

Electric car running costs

Owning and operating an electric car involves some costs that differ from conventional petrol or diesel cars (also known as “Internal Combustion Engine” or “ICE” cars). Even though some costs currently might be higher compared to traditional vehicles, such as the purchase price, others might be less than you think, especially in the long run.

Here are some of the main costs associated with running an electric you need to be aware of:

Up-front purchase price

Yes, the purchase price of electric cars is generally higher than traditional petrol or diesel cars. The reason is mainly due to the cost of the car’s battery, which is typically made of raw materials including aluminium, copper, cobalt, nickel, manganese, graphite and lithium – all expensive materials which push up the overall price.

But don’t let that put you off. The creation of EV batteries keeps evolving as does supply of new car brands and car components, and while the batteries are becoming more powerful and durable, their costs have been decreasing over the past decade and are expected to drop even more in years to come. So, the purchase costs of electric cars continuing to fall and are expected to become more and more affordable for all!

To support people going greener by choosing an electric car, there are several ways people can get access one, such as an electric car Business Lease or electric car Salary Sacrifice schemes, both of which are worth exploring. If you’re considering buying an EV, take a look at our blog on how to buy an electric car.

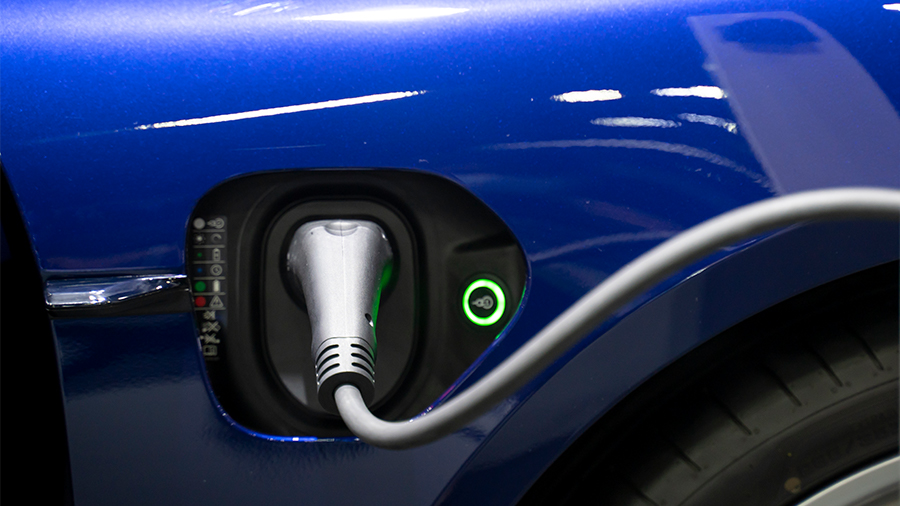

Electric car charging costs

Understanding the costs of charging your electric car before you buy or lease a shiny new EV are essential. While the charging costs depend on the electricity rates in your home or area, and the type of charging point you use, recharging your electric car is generally significantly cheaper than filling your tank with petrol or diesel.

But to make the best out of your electric car, you should consider installing a charger at home, because the charging costs are typically lower than using a public charge point especially if you can find a tariff that has been created for EVs at off-peak times.

Maintenance and repairs of electric cars

For most people, it’s cheaper to run an electric vehicle than a petrol or diesel car – with a recent study suggesting that owning an EV could save you an average of £700 a year.

That’s because an EV car’s battery, electronics and motor need very little maintenance, all electric cars are automatic too. Plus, there’s less fluids like engine oil, and wear and tear of your brakes is generally lower too.

Your electric car will need a service though like ICE cars including:

- Fluids and coolant – Though your electric car does not need oil, it requires a routine check on these 3 fluids in EVs; coolant, brake fluid, and windshield washing fluid.

- Brakes – Electric cars are clever, using ‘regenerative braking’, which means brake pad and disc wear is significantly reduced. But they will of course need replacing every now and again.

- Tyres – EV’s are naturally going to be heavier than normal cars due to their batteries, so you’ll need to ensure your tyres are kept within legal limits.

- Suspension – Like the tyres, EV car suspensions will be impacted by the weight of your vehicle, but they’ll be checked as part of your regular servicing.

We also explore more about servicing electric cars a bit further on in this article.

Electric car insurance

And finally, insurance is another essential cost to think of when purchasing or leasing any car and it’s worth keeping in mind that some electric cars can be more expensive to insure compared to petrol or diesel vehicles.

The reasons behind higher insurance costs are simple – there are more expensive materials in electric cars, so the repairs can be lengthy and more expensive. Read our blog to find out more about why electric cars are more expensive to insure.

But if you’re leasing your EV through an electric car salary sacrifice scheme with work, then sometimes the insurance costs are included in your monthly fee, and because this comes out of your pay before tax, you’ll benefit from added tax relief.

Charging an electric car

Essentially, there are two common ways of charging an electric vehicle – home charging and the use of public charging points. Unlike refuelling a petrol or diesel car, the costs of charging an electric car depend on the charging methods and the applicable electricity rates.

Home charging is the most convenient and cost-efficient way to charge an electric car. You can technically plug your car directly into a 240-volt outlet (these are the standard plugs you have in your home). However, this type of charging is not always recommended as there could be safety implications with EV’s requiring a lot of power and the charging will be very slow. For those without the space to install a home charger, they should find out if there is on-street-charging or the proximity of other public chargers – you can do that here.

If a driver has access to a driveway or off road parking, its common to install a home- charger for faster charging. It’s worth noting that EV chargers draw a considerable amount of power, so make sure you get an appropriate survey before having anything installed.

Home charging costs can vary, depending on factors such as what type of EV you own and which electricity tariff you use – but it could be as little as 2p per mile.

Most people who have an electric charger installed at home and charge at night when tariffs are lower. Off-peak tariffs cost less because the demand for electricity is low and energy providers often have lower rates.

You can learn more about charging your electric car at home by reading our Ultimate Home Charging Guide.

Public EV charging points

If you’re away from home or travel longer distances, using public charging points is a convenient way to recharge your electric car on the go. While the prices of some public charging points are based on the amount of electricity used, certain stations charge you for each minute of the charging process.

If you’re regularly using public charging points, it’s worth considering signing up for a subscription plan, as they sometimes provide discounted rates.

Finally, don’t forget that the UK offers a network of free EV charging points, usually located at supermarkets, as well as public and workplace car parks or hotels. While using free charging points is obviously the cheapest way to charge your electric car, it might not always be the most practical option as they may have access restrictions or lower charging speeds.

We’d recommend downloading an EV charge point map like Zapmap to plan the best option ahead of time! If you have your eye on a Tesla, you can use their trip planner to help plot range and chargers en-route for you.

Electric car cost per mile

Calculating the cost per mile for driving an electric car involves considering a number of factors, including electricity rates, vehicle efficiency, and maintenance expenses.

How to calculate the cost per mile of your electric car

Battery kWh Size / Your Cost Per kWh to charge = Cost per Range

Your Cost per Range / The Vehicle’s Stated Driving Range = EV Cost per Mile

Or, if your electric car shares its efficiency by kWh per mile:

- Determine your EV’s efficiency in terms of kWh per mile. This figure can usually be found in your vehicle’s specifications or documents.

- Check your electricity rates, typically measured in pence per kWh. In the UK, the average price of kWh sits around 24.5p/kWh.

- And finally, multiply the kWh/mile efficiency by the electricity rate to determine the cost per mile. For example, if your vehicle consumes 0.3 kilowatts over one mile and your electricity costs 30p per kWh, the cost per mile would be £0.09.

Do electric cars need servicing?

One of the biggest advantages of electric cars is that they require much less maintenance. Electric cars operate on a battery rather than an internal combustion engine like petrol or diesel cars, so they have fewer moving parts.

But just like any vehicle, electric cars still need regular servicing and attention. For example, qualified car mechanics will connect your electric car to a diagnostic machine to detect any possible fault codes that might require some work.

Common routine maintenance of electric cars

- Tyre rotation and alignment

- Inspection of your car’s charging point and charging cables

- Brake inspection

- Coolant system check

The battery is a critical part of all electric cars, and while it shouldn’t require any professional attention when you purchase or lease a brand-new EV, there are a few simple tips to follow to maintain the battery’s health and prolong its life, including:

- Minimising exposure to high temperatures

- Avoiding the use of fast chargers every time you charge

- Only charging fully for longer distances

Summary

So, what’s the conclusion? The costs of running an electric car can vary depending on the type of vehicle you choose, the electricity tariff you sign up to, and the mileage you make on average.

But the financial benefits of owning an EV could be big. There are potential tax incentives through an EV salary sacrifice scheme or an electric car business lease. And that’s on top of lower running costs and fewer maintenance requirements. All of these savings will add up, benefiting your budget while making a positive impact on the environment.

Discover electric cars

Discover electric cars that are available through our partner CBVC today.

Discover cars available